Buzz About Triggers About Next Recession

Have you been hearing a lot of buzz about entering another upcoming “recession”?

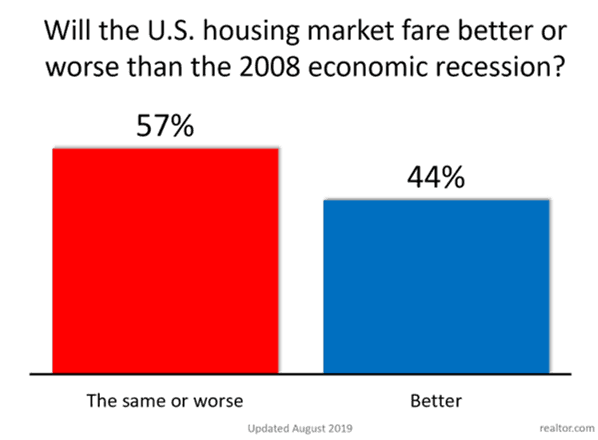

A recent survey from the National Association Of Realtors found that 57% of consumers believe that the housing market will be the same or worse than in 2008!

And, worse, 55% of people said they would HALT their home search if a “recession” occurs.

Know one knows for sure when the next “recession” will occur. What is known, however, is that a housing market crash is one of the least likely reasons to trigger a recession this time around (vs. 2008).

With one of the most highly contested presidential elections coming up, narratives from all different agendas will be coming out. And, as we all know… fear sells headlines.

We wanted to take this opportunity to share with you local and national data, historical trends, and expert predictions. This way, you will have more clarity than the average consumer and will be able to make more informed decisions about your next move.

- Local 10 Year Appreciation Trends and Inventory

- Hillsborough County

- Pinellas County

- Pasco County

- Last 5 Historical Recessions - Only 2 Caused A Price Decrease, 3 Caused Home Price Increases!

- Possible Triggers For Next Recession

- Projected Appreciation Going Forward

- Delinquency And Credit Availability

- Current Interest Rates - Q4 2019

- Bottom Line

- Why We Think This Information Is Important To Share

Local 10 Year Appreciation Trends and Inventory

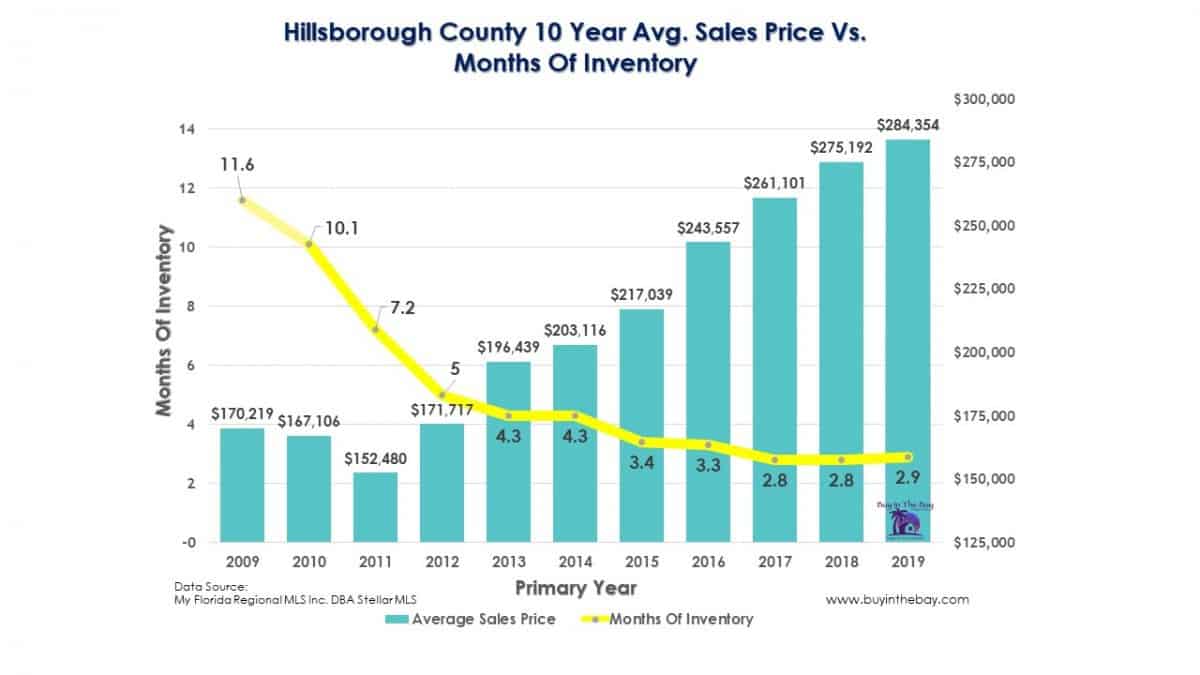

Lack of inventory, low-interest rates, and a growing pool of buyers are all important factors in the continued appreciation. The data below is hyperlocal to Hillsborough County and pulled from our local MLS, exploring all of the residential homes that have sold in the past 10 years.

For the clients that purchased from us 5+ years ago, congratulations! your home has gone up an average of 30%-40%! Even if you bought last year, you are looking at around 3% appreciation (to date), which contradicts many people’s beliefs that home prices would fall this year.

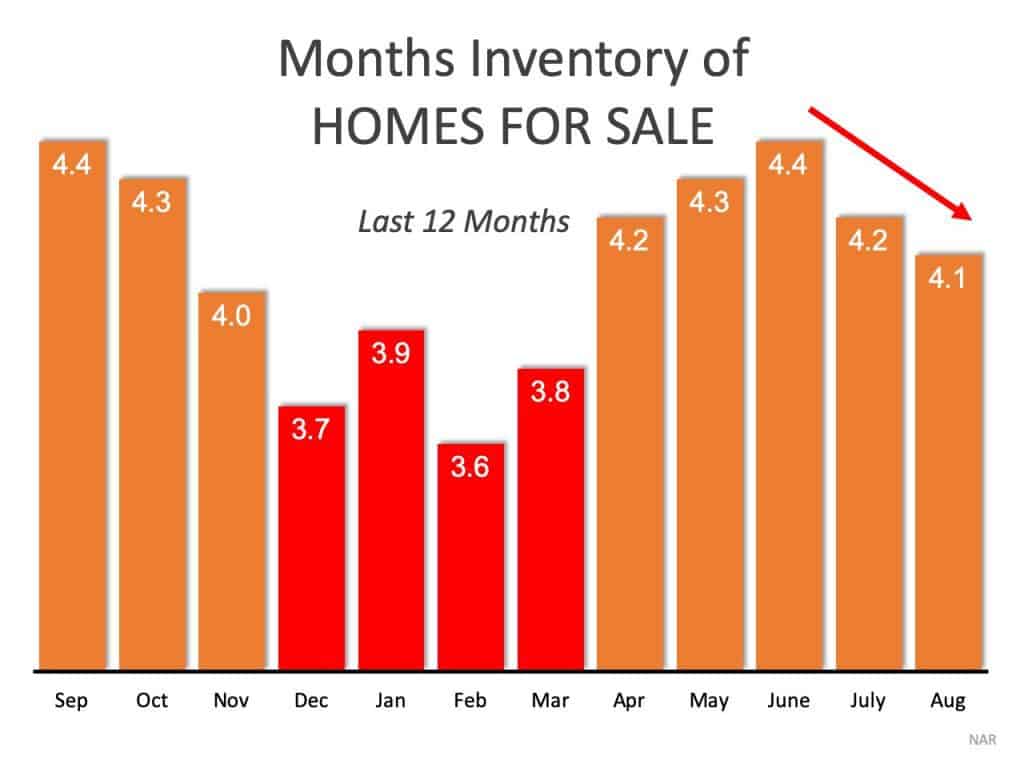

Months of inventory are also an essential factor in appreciation. A stable market is 6 months of inventory. This means that there is an exact amount of houses for the number of buyers out there.

Hillsborough County

Inventory levels were down to only 2.9 months (Sept 2019) from an all-time high of 19 months in Jan 2009. We will run out of housing in Hillsborough County in approx three months if no more homes are listed. There are simply not enough houses to fulfill demand.

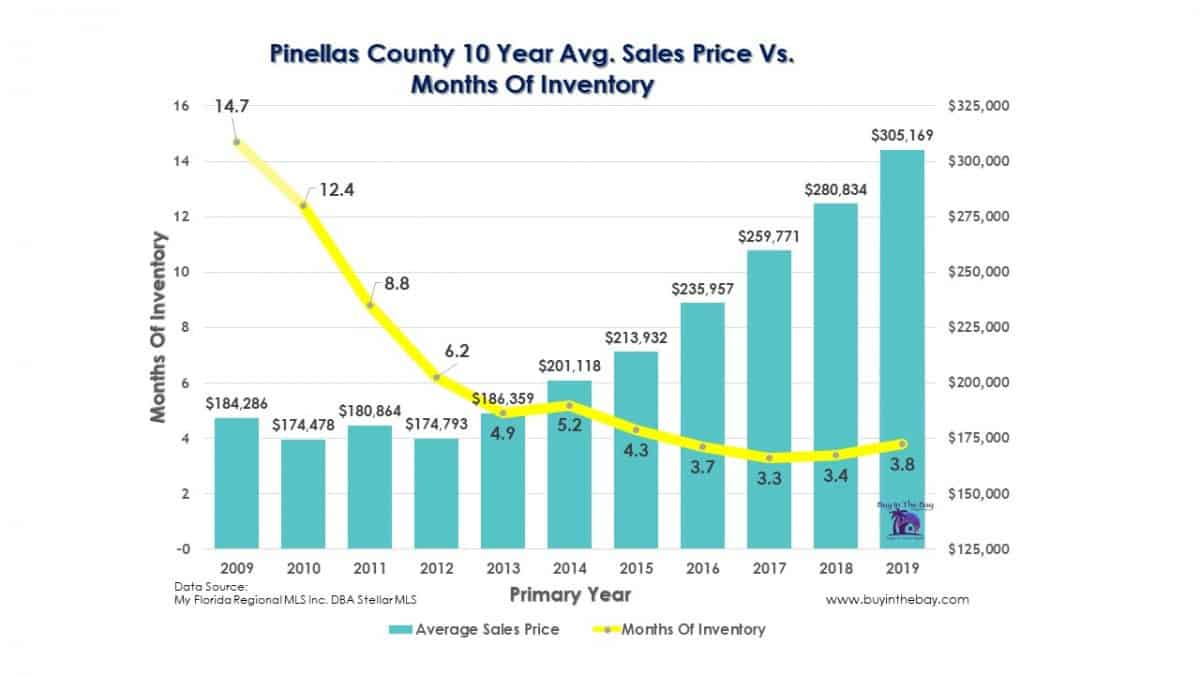

Pinellas County

For Pinellas County – We are at 3.8 months of inventory (down from a high of 22 months in January 2009). The average sales price is now $305,169, up from the 10 year low of $174,478 in 2010.

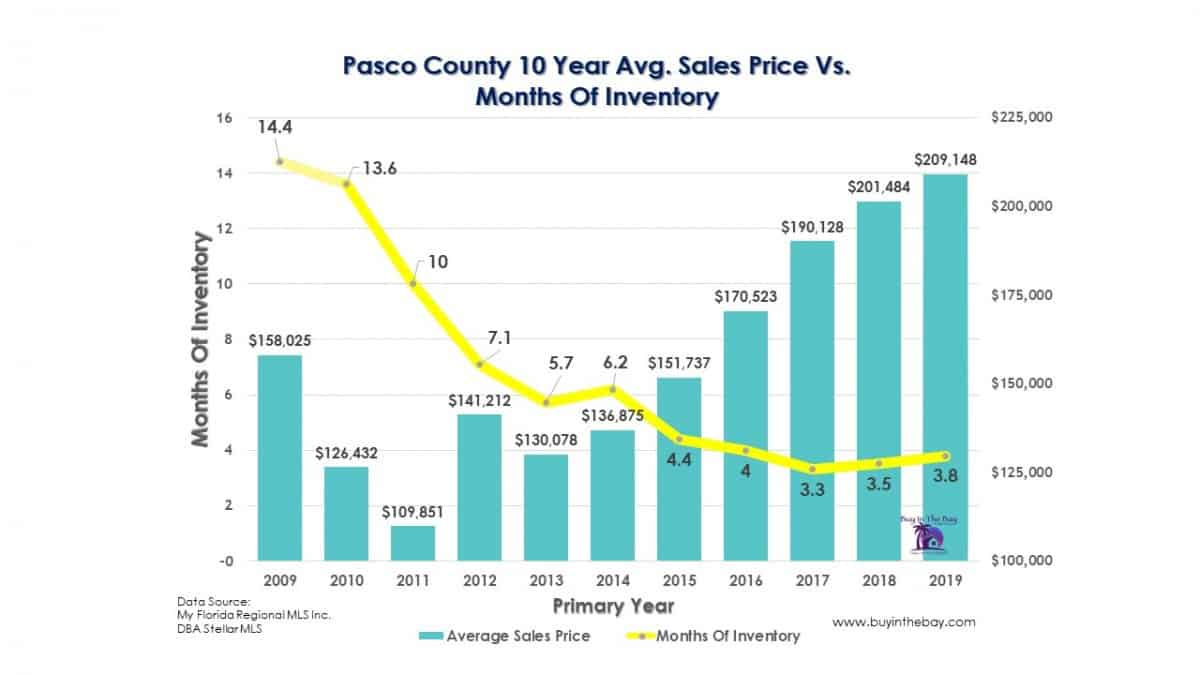

Pasco County

For Pasco County – We are also at 3.8 months of inventory (down from a high of 21 months in January 2009). The average sales price is now $209,148, up from the 10 year low of $109,851 in 2011.

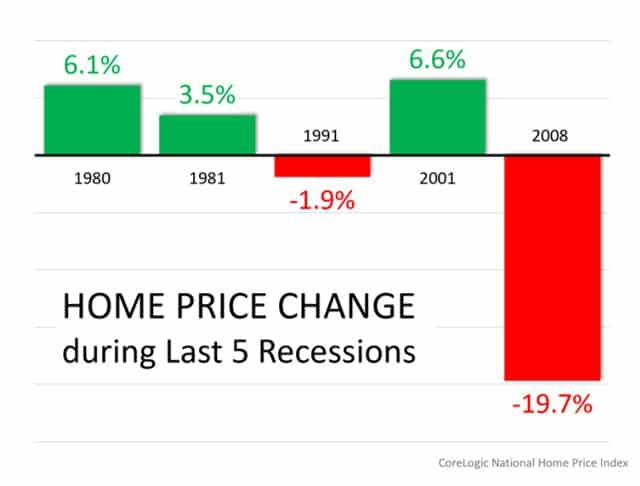

Last 5 Historical Recessions – Only 2 Caused A Price Decrease, 3 Caused Home Price Increases!

The technical definition of a recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in the GDP in two successive quarters.” – Merriam-Webster Dictionary.

The word “recession” is not as scary as it sounds, when you take into account it is caused by only two-quarters of an economic slowdown.

And a “recession” does not mean that home prices will decrease. In fact, only 2 of the last 5 recessions impacted the housing market, in the other 3 recessions, home prices actually increased!

Possible Triggers For Next Recession

Pulsemonics (a panel of over 100 economists, investment strategists, and housing market analysts) have formed a list of the top 10 triggers for the next recession (image on the left).

A “housing slowdown” at the bottom of the list. Trade policy, Stock Market Correction, Geopolitical events, monetary policy, and corporate debt are much more likely to trigger the next “recession”.

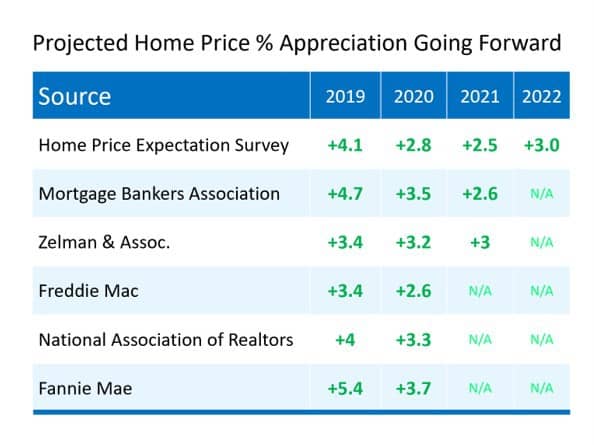

Projected Appreciation Going Forward

And national top housing authorities are all in agreeance that prices will continue to go up within the next year at an average of 3-5%, which is a NORMAL, healthy market. You will still be building wealth.

Another critical difference between today and the last “great recession” housing crash, 53% of homes have 50% equity or more, and 37% do not have a mortgage at all. This is an exact REVERSAL of 2006-2009.

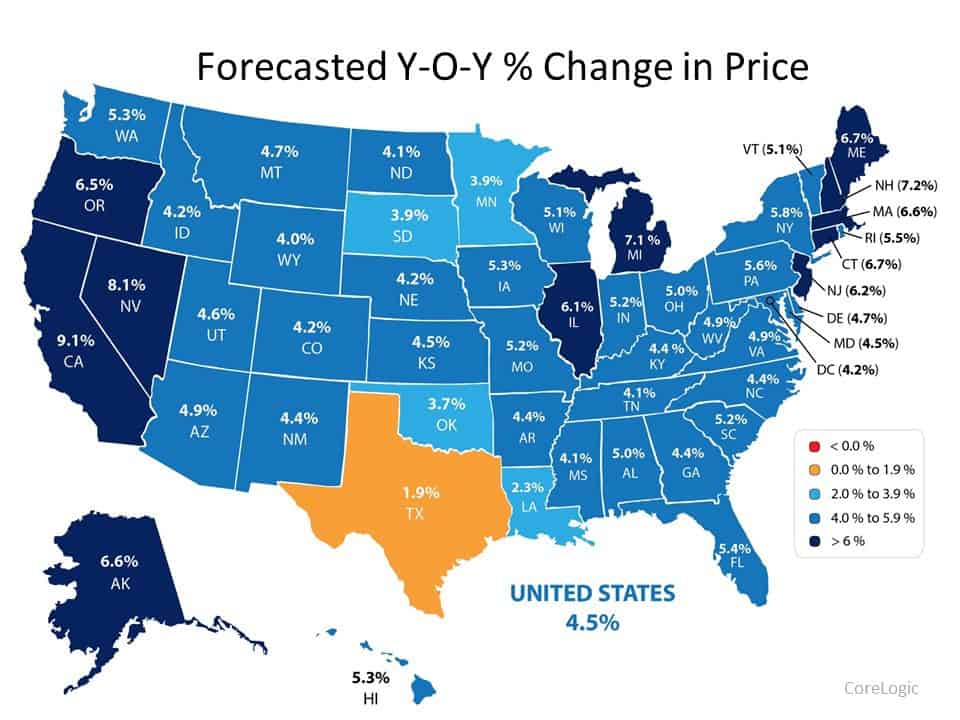

Last Year, Corelogic predicted prices to appreciate 3.6%. Now, in the upcoming 12 months, they predict prices to go up 4.5% nationwide. And even better, Florida is predicted to go up 5.4%, above the national average. This further shows price acceleration caused by a lack of inventory and low-interest rates.

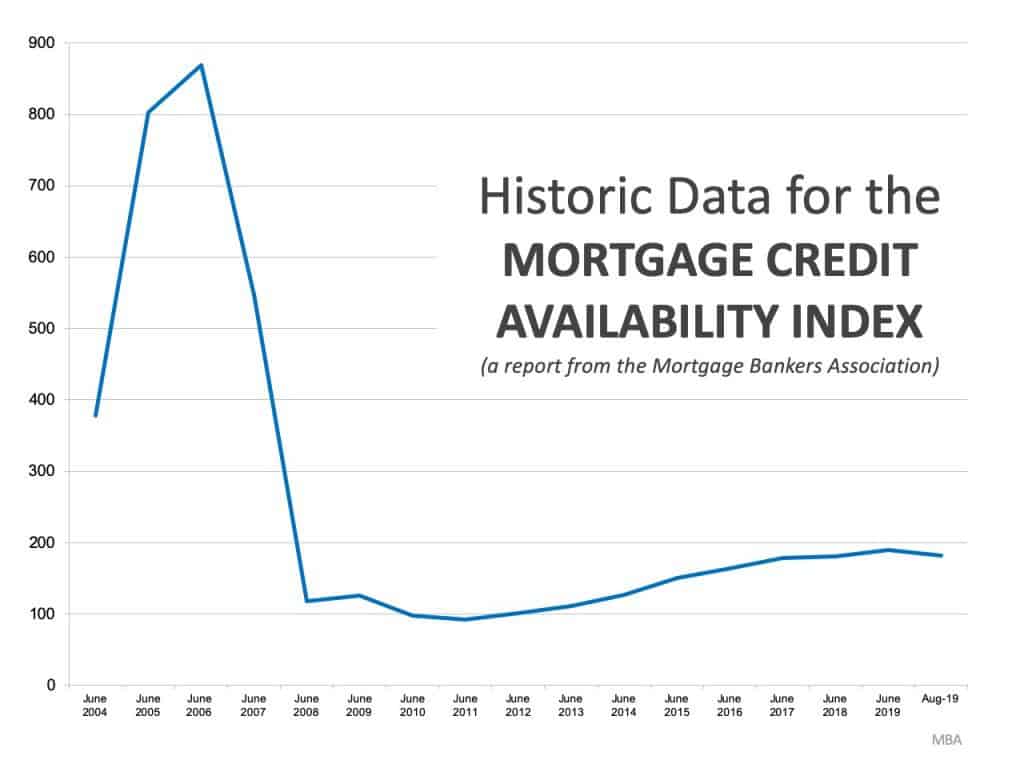

Delinquency And Credit Availability

Delinquency rates are the lowest they have ever been. Americans have learned the hard lesson of using their home equity as ATMs. Data shows that they are now using their equity to re-invest by sending their kids to college, consolidate debt, and start businesses.

And, the lending market is still incredibly conservative vs. pre-2009. The average credit availability index ranges from 375-450. In 2006, that number rose above 900 (too much readily available credit was available.) Post-2008- it went down to 100.

Currently, we are only at an index of 200, which is much more conservative than normal. A conservative lending market is one of the most critical factors in keeping the housing market stable.

Article Source: Mortgage Credit Availability Index – Mortgage Bankers Association

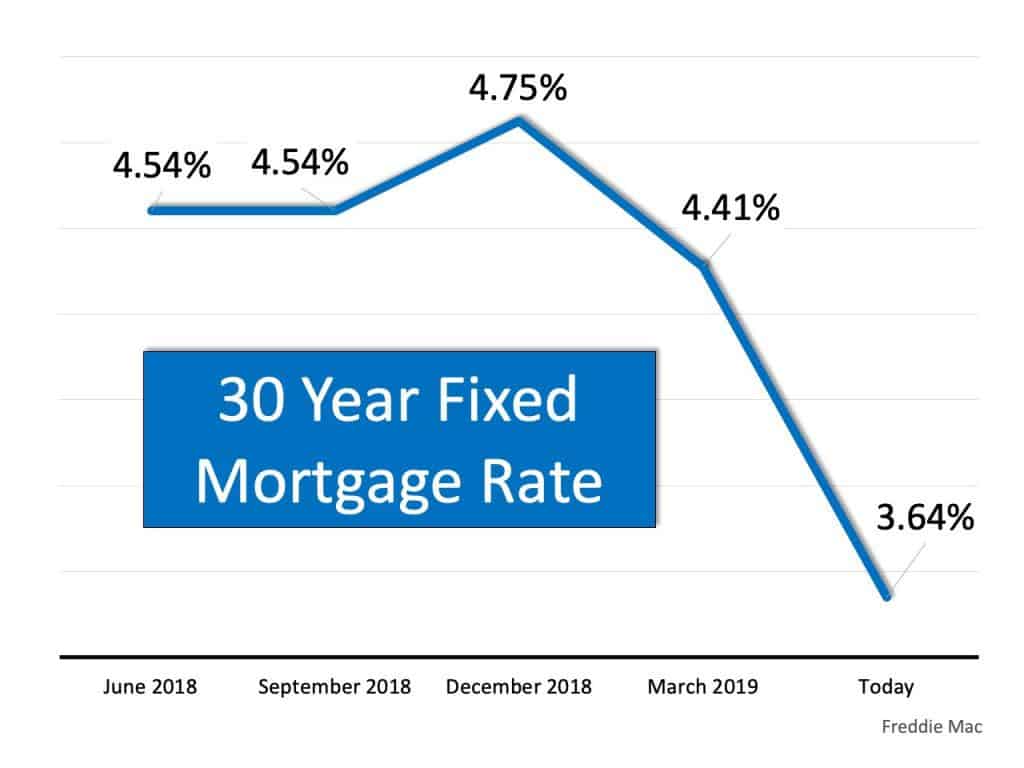

Current Interest Rates – Q4 2019

Last but not least, interest rates are still historically low (@ 3.75% October 2019), making it one of the best times to consider buying or move-up. Rates did go up last fall but have been lowered to where people were comfortable, and prices started going back up again.

Source: Freddie Mac Weekly Mortgage Rate Data

Bottom Line

- We are still well below a healthy 6 months of inventory and have a housing shortage

- A “recession” is technically ONLY 2 quarters of economic slowdown

- Only 2 of the past 5 recessions impacted the housing market, the other 3 “recessions” the prices went up!

- A Housing Slowdown is #9 out of #10 possible triggers of the next recession

- All top authorities in real estate project a home price appreciation of 3-4 %in 2020

- 53% of homes have 50% equity or more, 37% have no mortgage

- Delinquency rates are at the lowest they have ever been

- Credit availability indexes are still lower than normal

- Interest rates are still at a historic low

We have been in the real estate industry before, during, and after the last “great recession” of 2008. The current status of the economy and the housing market COULD NOT BE MORE DIFFERENT between these two time periods.

It HIGHLY concerns us that 57% of consumers BELIEVE that an upcoming “recession” will create a housing crash worse than 2008, and 55% would HALT their search altogether.

Buy In The Bay Realty Group’s top priority is to keep you well informed with current and historical research, balanced reporting, and reputable data. We will always be here to help you navigate through the current marketplace and make sure you are well-informed consumers able to make sound financial decisions.

Buying and selling real estate is one of the most important decisions of a person’s life. All of the local and national market data, shortage of inventory levels, growing demand, conservative lending, and low-interest rates make it almost impossible for an upcoming “recession” to create a housing market crash similar to 2008.

Do not give up on moving to the next chapter of your life in your dream home and miss this opportunity to expand your family’s generational wealth because of fear of a repeat of 2008!