The recent surge in interest rate hikes has captured the attention of media outlets and prospective homebuyers alike. For those contemplating a move, this is a significant curveball. If you’re wrestling with the decision to postpone your plans or proceed, it’s essential to grasp the real implications.

How Interest Rate Hikes Might Affects You

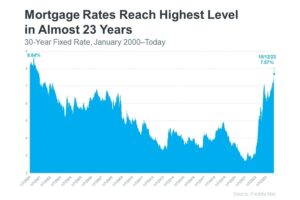

If you’ve been watching news about interest rate hikes, you’re probably aware that rates have recently hit their highest point in over two decades (as illustrated in the graph below).

It’s undeniable that mortgage interest rate hikes have risen compared to recent years. When rates climb, it directly impacts the overall affordability of homes. Here’s how it works: as interest rates increase, the cost of borrowing money for your home purchase rises.

Consequently, your monthly mortgage payment for your future home loan also swells.

The Urban Institute sheds light on the current impact on buyers and sellers:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Some individuals opt to hit the interest rate pause button on their plans due to the current mortgage rate landscape. But what you’re likely pondering is whether this is a sound strategy.

Where Do Mortgage Rates Head with Interest Rate Hikes?

You’re not alone if you’re eagerly awaiting a drop in mortgage rates. Many people are hoping for this development. However, here’s the catch: no one can predict when or if it will occur. Even experts find themselves unable to offer a definitive forecast.

While projections indicate that rates may decline in the coming months, recent data shows an upward trend. This discrepancy underscores the unpredictability of mortgage rates.

The best advice for navigating this situation is simple: don’t attempt to control the uncontrollable. This includes trying to time the market or predict future interest rates. As CBS News advises:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, concentrate on assembling a team of skilled professionals, including a reliable lender and a knowledgeable real estate agent.

They can provide insights into the market’s dynamics and what it means for you. Whether you need to move due to a job change, proximity to family, or another significant life event, the right team can help you achieve your goal, even amidst market uncertainties.

In Conclusion

The optimal guidance for your relocation is this: refrain from attempting to influence the uncontrollable, particularly mortgage rates. Even the most knowledgeable experts cannot accurately predict their future path.

Instead, concentrate on assembling a team of dependable professionals who can provide you with informed insights. When you’re prepared to initiate the process, please don’t hesitate to reach out.