When standing at the crossroads of homeownership, the choice to sell or retain your property can be a weighty one. The intricacies of the decision may be compounded by concerns about taking on a higher mortgage rate for your next residence.

If this quandary resonates with you, unlocking the nuances of equity could serve as your compass, guiding you towards a more informed and confident course of action. In the following discussion, we’ll delve into the concept of equity and its current relevance, shedding light on its potential to transform your housing journey.

The Dilemma of Homeownership: To Sell or Not to Sell

As a homeowner, you’re on the brink of a pivotal decision—whether to sell your home in today’s real estate climate.

Amid this choice, the concern about taking on a higher mortgage rate for your next property might loom large.

If uncertainty is clouding your judgment, a deeper grasp of equity could be your guiding light, boosting your confidence in this crucial decision.

Demystifying Equity: Its Dynamics and Functionality

At its core, equity signifies the current value of your home minus the outstanding loan balance. Recent trends have showcased an unexpected surge in equity growth, surpassing initial expectations by a wide margin.

Over the past few years, the real estate market experienced a remarkable escalation in property prices, leading to a rapid boost in your equity position.

Even as the market gradually finds its equilibrium, an interesting asymmetry persists—there are more potential buyers actively seeking properties than the number of homes available for sale.

This supply-demand mismatch has rekindled a climb in property prices. Rob Barber, the CEO of ATTOM, a prominent property data provider, elucidates this phenomenon:

“Equity levels remained robust even during the recent economic downturn, and presently they are rebounding with even greater strength.”

Harnessing the Potential of Equity in Today’s Landscape

In the prevailing landscape, marked by challenges of affordability, your accrued equity can prove to be a game-changer as you navigate your transition.

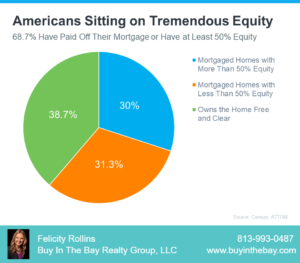

Here’s why: Drawing insights from data provided by ATTOM and the Census, a noteworthy 68.7% of homeowners have either fully repaid their mortgages or possess at least 50% equity (as depicted in the chart below):

This effectively means that close to 70% of homeowners currently hold a substantial equity stake.

Upon deciding to sell your property, you gain access to this equity, which can play a pivotal role in your next property acquisition. It could potentially cover a significant portion, if not the entirety, of your upcoming down payment.

In fact, it might empower you to make a considerably larger down payment on your next home, thereby reducing your need for financing.

Furthermore, if you’ve established a lengthy tenure in your current home, you might have accumulated enough equity to facilitate an all-cash purchase. If this scenario resonates with your situation, you could bypass the need for borrowing altogether, eliminating concerns about prevailing mortgage rates.

Unveiling Your Equity: Taking the Next Step

To accurately gauge the extent of your equity, the recommended course of action is to enlist the assistance of a trusted real estate agent for a comprehensive Professional Equity Assessment Report (PEAR).

The Final Verdict: Equity’s Resounding Impact

If you’re contemplating a residential move, the equity you’ve built up possesses the potential to wield significant influence. To uncover the true extent of your equity within your current dwelling and to explore avenues for harnessing it to facilitate your upcoming acquisition, let’s initiate a conversation.

Your next move could be more empowered than you ever imagined, thanks to the equity you’ve accumulated.