Intro To Appraisals – The Deal Maker or Breaker

Unless you are a cash buyer, your bank will require you to get an appraisal for the purchase of your home, or refinance. There are so many data sources out there now at our fingertips which has been helpful, yet has created mass confusion along the way.

Recent Appraisal Issues

There is a new trend of appraisal issues to be aware of, even in multiple offer situations.

We have had a 100% success rate pricing homes properly and working with appraisers, and preventing or fixing appraisal issues. In fact, last month, we successfully fought a VA appraisal that came up $12,500 short, by providing a 13-page case study to the VA Senior Appraiser proving that 2 level townhomes with less square footage historically sell for more than their 3 level townhome counterparts in our local area. This case study can be provided upon request, by emailing us at info@buyinthebay.com

In today’s housing market, home prices are increasing at a slower pace (3.4%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly. In the mind of the homeowner, annual home price appreciation over 6% has become the new normal.

This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

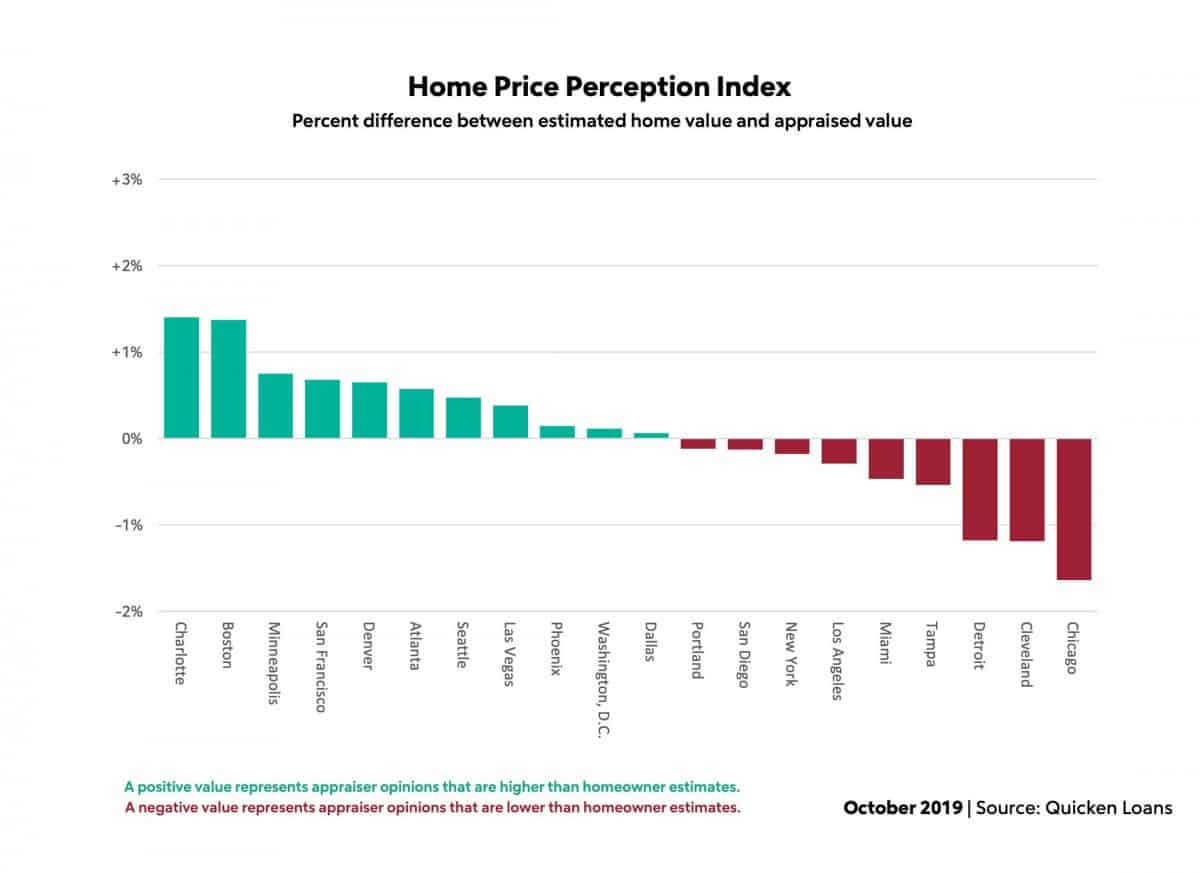

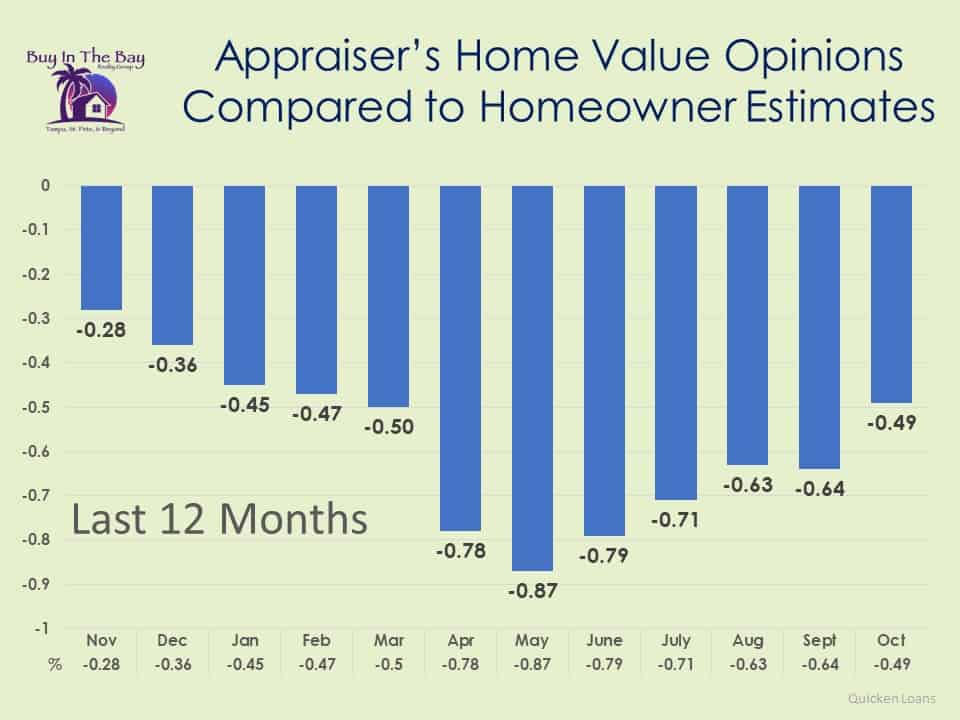

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and the appraiser’s evaluation of that same home.

Over the last four months, the gap between the homeowner’s opinion and the bank’s appraisal has narrowed to 0.63%. This means actual appraisals and the perceptions homeowners have of the value of their homes is getting closer to even, but still presents an opportunity for improvement.

It remains wide enough to create challenges when appraising a house, making the value of a real estate professional who can help you properly price your home more important than ever.

While the gap between appraisal and homeowner estimates remains fairly wide, another trend is also becoming more common…

According to realtor.com,

“the share of homes which had their prices cut increased by 2% compared to last year.”

In fact, 37 out of the 50 largest U.S. housing markets saw an increase in overall price reductions. In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price.

This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong – the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start.